Medicare Advantage Plans, also known as Medicare Part C, are an alternative way to receive Medicare benefits. Here’s how they work:

**1. Overview of Medicare Advantage Plans

- Private Insurance Plans: Medicare Advantage Plans are offered by private insurance companies approved by Medicare. They provide all the benefits of Original Medicare (Part A and Part B) and often include additional benefits.

- Bundled Coverage: These plans bundle together Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Many also include Medicare Part D (prescription drug coverage).

**2. Additional Benefits

- Extra Coverage: Beyond what Original Medicare covers, Medicare Advantage Plans often include additional benefits such as vision, dental, hearing, and wellness programs.

- Out-of-Pocket Limits: Medicare Advantage Plans have a maximum out-of-pocket limit for covered services, which can help protect you from high costs. This limit varies by plan.

**3. Types of Medicare Advantage Plans

- Health Maintenance Organization (HMO): Requires members to use a network of doctors and hospitals. Referrals from a primary care doctor are often needed to see specialists.

- Preferred Provider Organization (PPO): Offers more flexibility in choosing healthcare providers and does not require referrals, though using in-network providers usually costs less.

- Exclusive Provider Organization (EPO): Similar to an HMO but typically does not require referrals. Coverage is only available if you use network providers, except in emergencies.

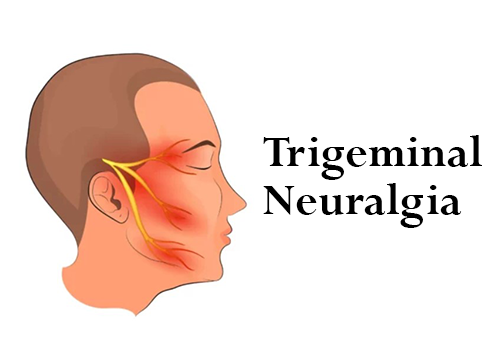

- Special Needs Plans (SNPs): Tailored for people with specific health conditions or who need additional support. These plans provide specialized care based on the individual’s needs.

**4. Enrollment

- Eligibility: To enroll in a Medicare Advantage Plan, you must be eligible for Medicare Part A and Part B and live in the plan’s service area.

- Enrollment Periods: You can enroll during the Annual Enrollment Period (October 15 to December 7), or during the Initial Enrollment Period when you first become eligible for Medicare. There are also Special Enrollment Periods for specific circumstances.

**5. Costs

- Monthly Premiums: Many Medicare Advantage Plans have a monthly premium in addition to the Part B premium. Some plans have $0 premiums but may have higher costs for other services.

- Copayments and Coinsurance: You may have copayments (a fixed amount) or coinsurance (a percentage of the cost) for services. These costs vary by plan.

- Deductibles: Some plans have deductibles for certain services. These deductibles can vary depending on the plan.

**6. Network and Coverage

- Provider Network: Most Medicare Advantage Plans have a network of providers. Using in-network providers usually means lower costs, but you may have higher costs if you go out-of-network.

- Coverage Rules: Plans may have specific rules regarding coverage, such as requiring prior authorization for certain services or needing referrals for specialist care.

**7. Annual Changes

- Plan Changes: Medicare Advantage Plans can change their coverage, costs, and provider networks each year. It’s important to review your plan annually to ensure it still meets your needs.

**8. Switching Plans

- Changing Plans: You can switch plans during the Annual Enrollment Period or if you qualify for a Special Enrollment Period. If you’re not satisfied with your current plan, you can choose a different one during these periods.

Overall, Medicare Advantage Plans offer a comprehensive alternative to Original Medicare with added benefits and coverage options. It’s important to compare different plans and consider factors like coverage, costs, and provider networks to find the plan that best suits your needs.